Table of Contents

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

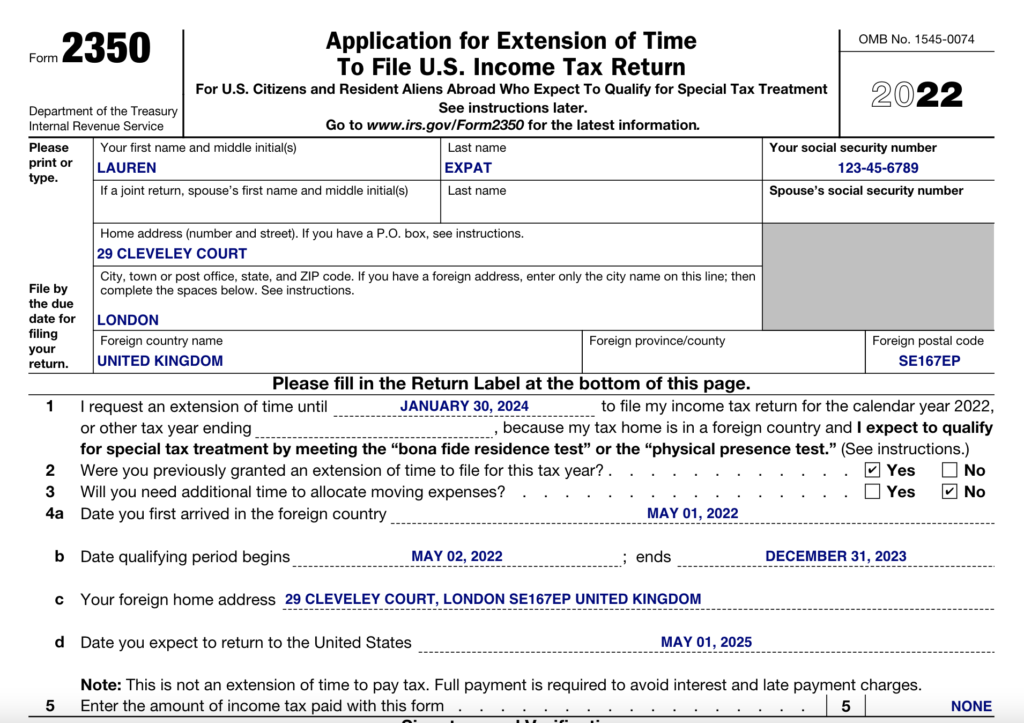

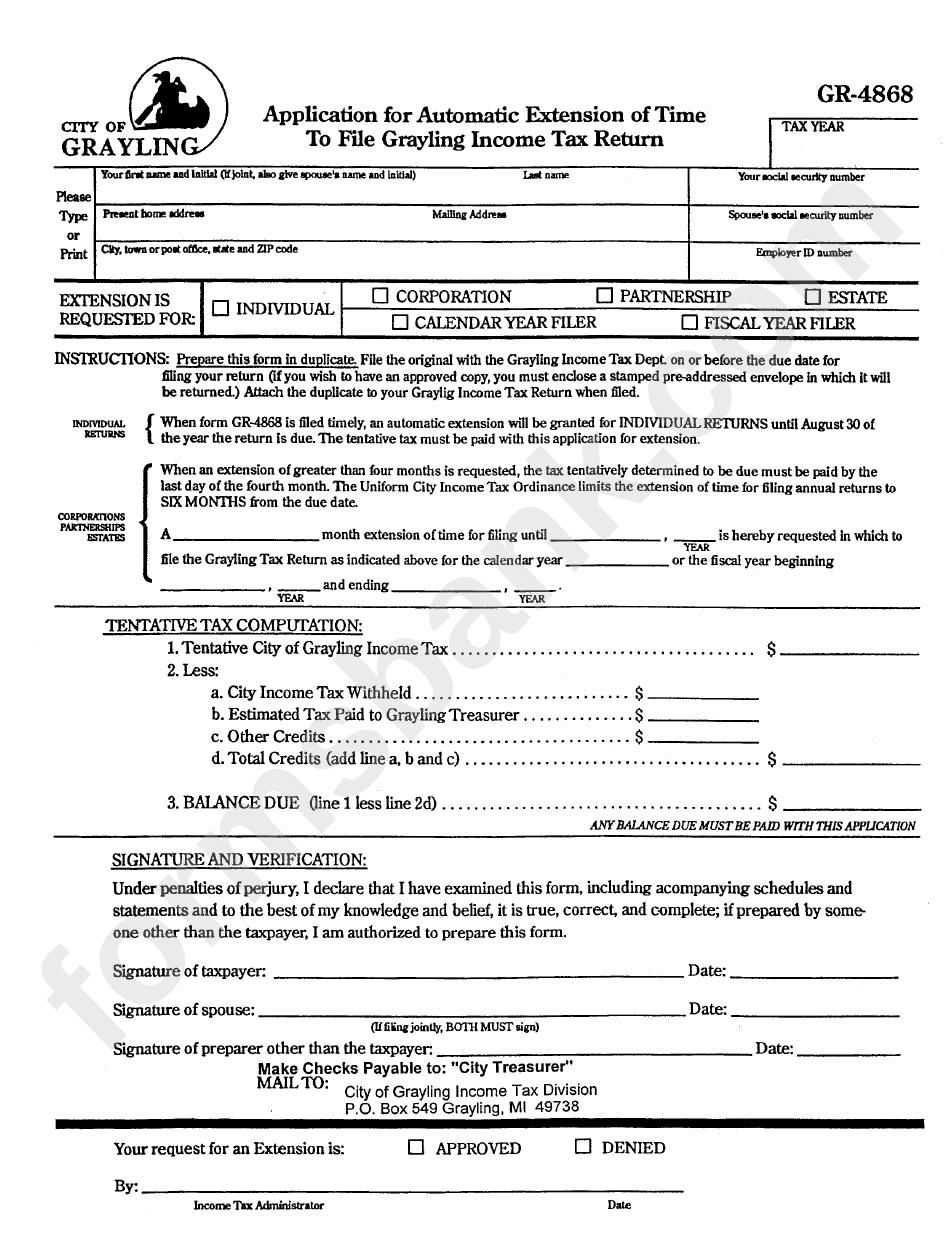

- Printable Tax Extension Form

- 10 Things to Know about Filing a Tax Extension - Hallows Company

- Tax Day misinformation on extensions, who has to file, deadlines | wkyc.com

- File Extension Taxes 2025 Free Pdf - Sophia M. Gaertner

- How Many Times Can You Ask For An Extension On Your Taxes?

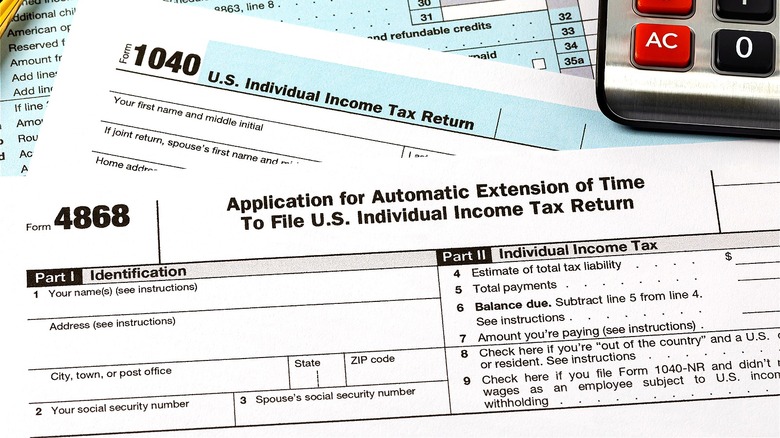

- Tax extension IRS automatically give without filing Form 4868 if you do ...

- 2018 Deadline for Federal Income Tax Extension Approaching - Joshua ...

- Do I Need to File a Tax Extension?

- Filing a tax extension - Diamond & Associates CPAs

Which States Are Affected?

What Is the New Tax Deadline?

The new tax deadline for individuals and businesses in the affected states is August 15, 2023. This means that taxpayers in these states have an additional four months to file their tax returns and make payments without incurring penalties or interest. The original deadline was April 15, 2023, but the IRS has extended it to provide relief to taxpayers who have been impacted by the natural disasters.

Who Is Eligible for the Tax Deadline Extension?

The tax deadline extension applies to all individuals and businesses in the affected states, including: Individuals who live or have a business in the affected states Businesses that have operations in the affected states Tax-exempt organizations that have operations in the affected states Taxpayers who are eligible for the extension do not need to take any action to receive the extra time. The IRS will automatically apply the extension to all eligible taxpayers.